Not known Incorrect Statements About FFNTF - Research - OTC Markets

4Front Ventures FFNTF Stock is Ready For Expansion for Beginners

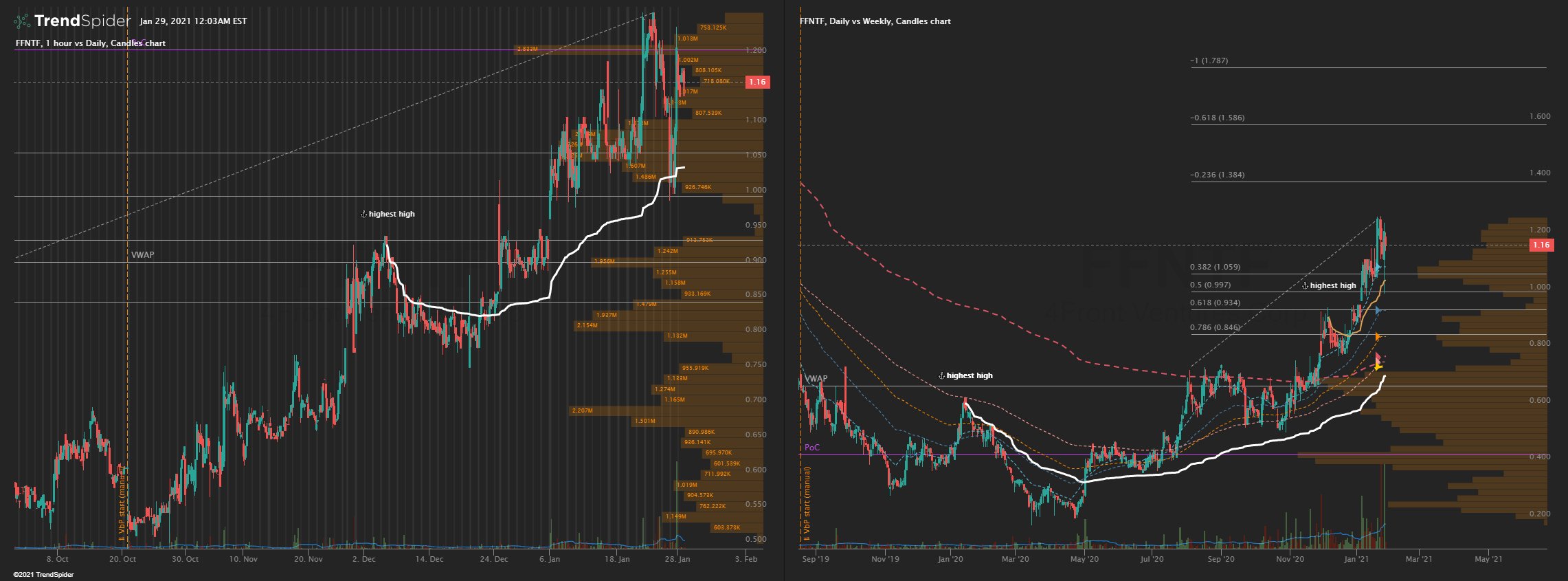

5% of present income. That is in line with the S&P 500's average numbers. That is a strong place to increase from. Expectations are that 4Front hits 38% with its future production capability. So, from this point, there will be continued growth higher in this metric. Continually, Found Here will iterate that 4Front is moving towards greater and higher revenues as their production begins in California and other states.

Net Profits Now that production is going to ramp up, and with increased margins trickling down through EBITDA, net earnings will be the next turning point: Net Profits: To see complete 4Front Ventures financial information check out FFNTF stock page When it pertains to net revenues, if we look above at the possibility of profits increasing 50% general, hitting an average of $50M per quarter over any following quarters, with a fixed operating cost and existing gross margins, you are looking at 33.

Offered a potential 35% in expense of items, and an extra 10% in continuing expenses, 22. 5% net incomes v profits. Keep these numbers in mind. Cash On Hand This might be a small source of concern that, while 4Front has access to cash they are short on cash-on-hand: Money On Hand: To see total 4Front Ventures monetary information go to FFNTF stock page I think that the phrase "Cash is King" will play out here in a big method.

However, definitely Canopy Development has shown that you can not look on a direct basis at simply that a person metric; you have to consider all metrics. In the meantime, cash is low and 4Front will need to work vigilantly to manage its money position. Cash: Debt Ratio When it comes to the cash: debt ratio, 4Front actually hits at the lower end of the spectrum comparatively as of the present financial declarations: Money Debt Ratio: To see total 4Front Ventures financial information go to FFNTF stock page Should 4Front hit its revenue objectives and are able to drift themselves, turning a corner with becoming cash circulation positive, this will likely play out perfectly fro them.

UNDER MAINTENANCE